Arguably the most anticipated and talked about budget announcement in years, the Autumn Budget provided an update on the government’s plans for the economy. Discussions on what the budget will contain has dominated the domestic news for weeks.

In today’s Autumn budget, Rachel Reeves announced a significant amount of changes - see the summary below to see how you are impacted:

National Living Wage / Minimum Wage

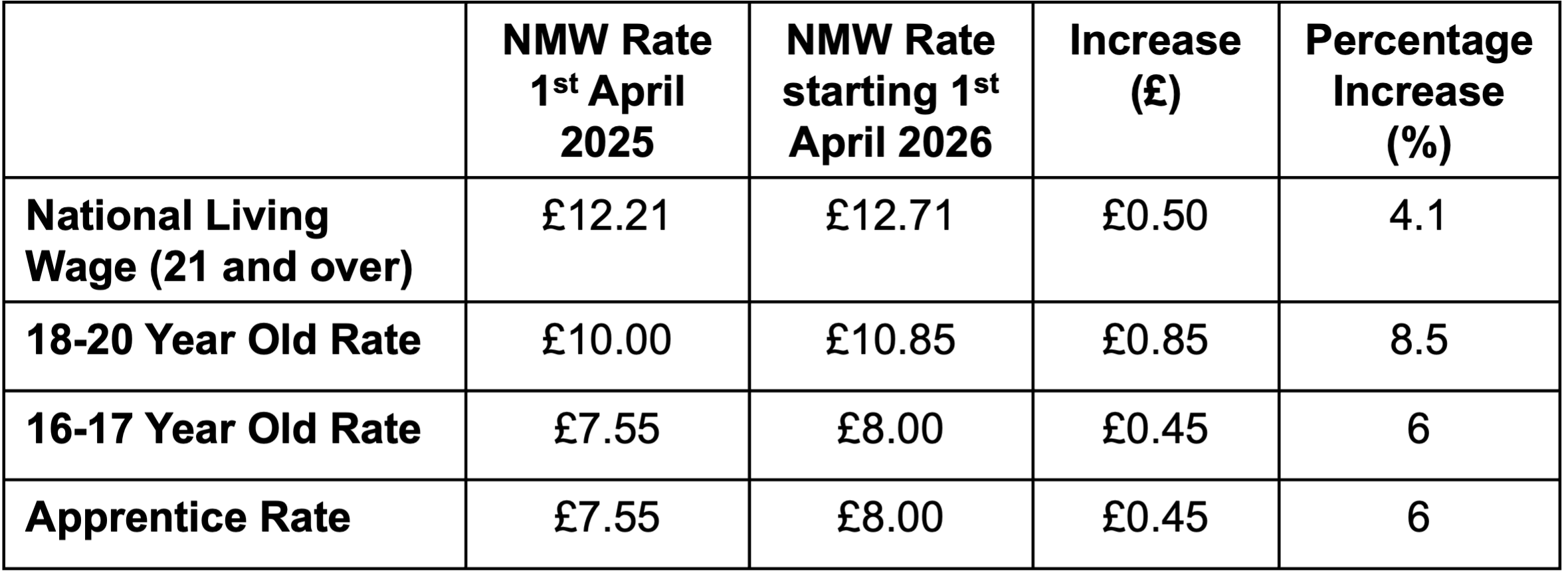

The National Minimum Wage (NMW) for those 21 and over, officially known as the National Living Wage and wages for those aged 16-20 are both changing from April 2026.

What do the announced changes mean?

The NMW is going up from April 2026 and the table below outlines the changes.

Changes in ISA’s

The £20,000 annual ISA allowance will be changing.

What do the announced changes mean?

From April 2026, a maximum of £12,000 can now be put into a Cash ISA - down from £20,000. The full annual allowance is still available for money invested into stocks and shares.

If you’re over 65 the full £20,000 annual allowance can still be put into a Cash ISA.

Freeze on Income Tax thresholds

The amount anyone can earn before paying tax is £12,570 a year. The Conservative government froze this threshold until 2028.

What will the announced changes mean for you?

Labour will now extend this freeze until 2031 - it means more people will pay higher rates of income tax as their pay rises.

Salary Sacrifice - Pensions

Currently people are able to “sacrifice” some of their salary and put this into their pension which means the salary that is sacrificed is not taxed.

What could the announced changes mean for you?

Contributions above £2,000 will face National Insurance from April 2029 which means a higher rate of tax will be paid.

Two Child Benefit Cap

Previously a cap was introduced that limited universal credit or tax credits to the first two children. This has now changed.

What could the announced changes mean for you?

From April 2026, the two child benefit cap will be scrapped.

Electric Vehicles (EV) Tax

There will be a new mileage tax for EVs from April 2028.

What could the announced changes mean for you?

From 2028-29, this charge will equal 3p per mile for battery EVs and 1.5 per mile for plug-in hybrid cars.

Property, Dividends and Savings Tax

Tax on property, dividends and savings will all be increasing.

What could the announced changes mean for you?

From April 2026, there will be a 2% increase . Basic rate taxpayers, who earn between £12,571 and £50,270 will now be charged 10.75% up from 8.75%. Higher rate tax payers, who earn between £50,271 and £125,140 will be hit with a 35.75% charge up from 33.75%

“Mansion Tax”

Properties worth over £2m will now be subject to an additional tax rate.

What do the announced changes mean?

For properties worth £2.5million or more, an additional annual charge of £2,500 will be added.

Summary

A number of significant changes were announced in today’s budget.

With the increase in the National Minimum Wage a number of people will find more money in their pocket from April 2026.

Amongst those who will also benefit from the Autumn budget are parents with more than two children when it comes to universal credit or tax credits, albeit any good news here may be offset by personal allowances being further frozen until 2031.

The sheer amount of changes across the board will impact everyone in different ways - in some areas people will be better off, but in a number of other ways many will be worse off.

Remember, CreditLadder can help you improve your credit score.

CreditLadder can improve your credit position by reporting your rent payments. CreditLadder is the first way to improve your credit score and position across all three of the main Credit Reference Agencies in the UK, namely Experian, Equifax and TransUnion. Building up a high credit score has a lot of benefits, including helping you access finance at better rates - this can also help save you money. CreditLadder also runs a free mortgage application service in partnership with Tembo which will tell you how much you could borrow.