How it works

Historically rent payments were never reported to Credit Reference Agencies. The great news is CreditLadder has helped thousands of tenants improve their credit score, and you could be next.

Report to one credit reference agency or all three of Experian, Equifax & TransUnion.

The UK has three main Credit Reference Agencies - Experian, Equifax and TransUnion.

It’s important to have the best credit position with all three agencies, which is why we recommend you report your rent to Experian, Equifax and TransUnion. By reporting to all three, you have all your bases covered!

Sign up in under five minutes

1. Enter your details

Confirm your identity with a few quick questions.

Provide your tenancy details so future rent payments can be reported to the credit agencies.

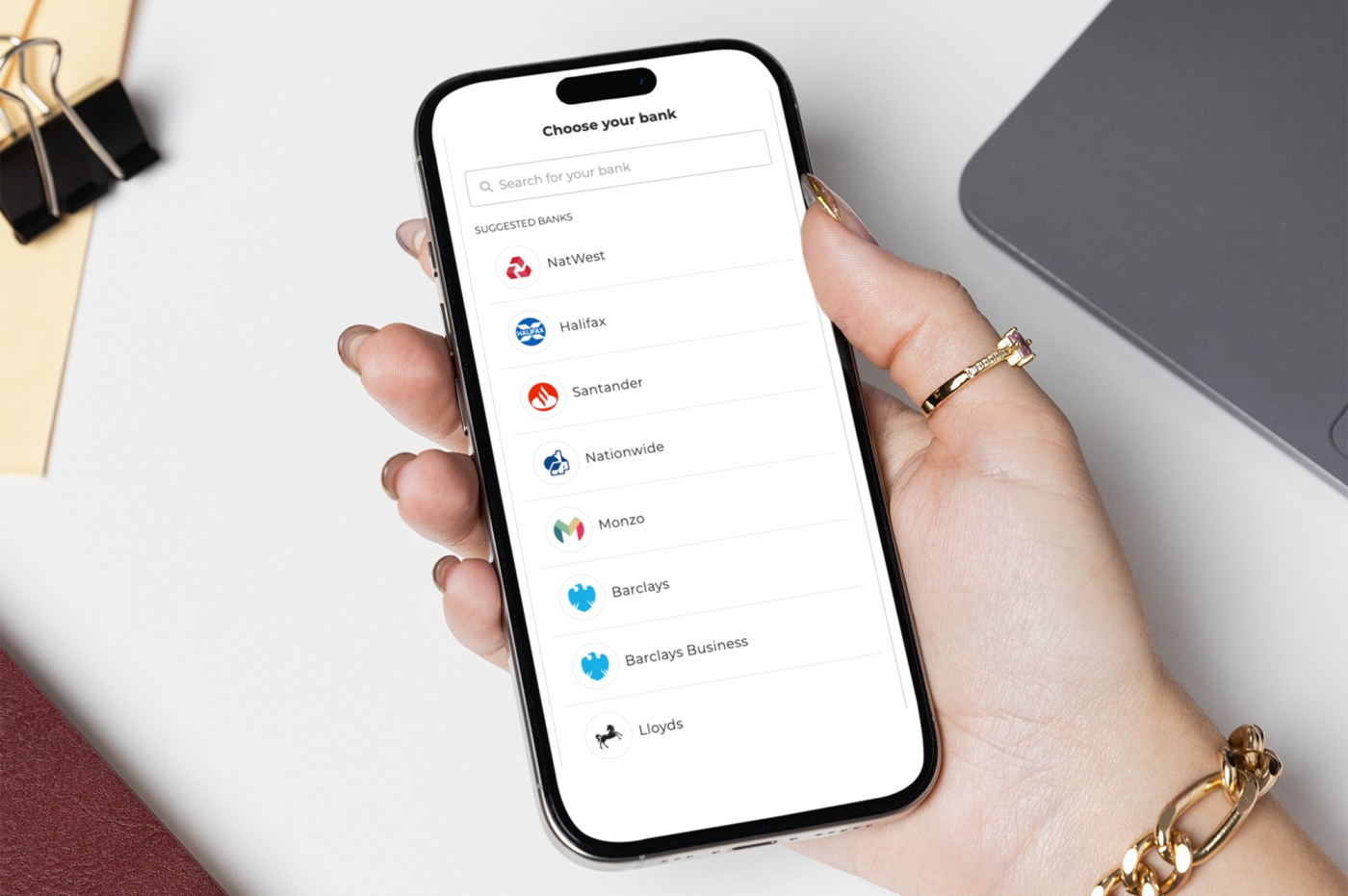

2. Connect your bank for read only access.

CreditLadder are FCA regulated and the Open Banking technology we use is supported by all major banks. Connect to your bank with confidence, thanks to high-level data encryption.

Supported banks: Bank of Scotland, Barclays, Chelsea Building Society, Chase (mobile only), Danske Bank, First Direct, Halifax, HSBC, Lloyds Bank, MBNA, Monzo, Nationwide, Natwest, Revolut, Royal Bank of Scotland, Santander, Starling Bank, Tesco Bank, Tide, TSB, Ulster Bank, Virgin Money, Wise and Yorkshire Building Society.

3. Pay your rent as normal

CreditLadder will read and identify rent payments through the secure access provided. Rent payments will appear on Experian, Equifax and TransUnion statutory credit reports after 6-8 weeks. We do not collect your rent.

How much does it cost?

CreditLadder offers tenants the opportunity to report their rent payments to one of Experian, Equifax or TransUnion for free.

CreditLadder also offers paid plans to give you the maximum benefit by reporting to all three major Credit Reference Agencies. This costs from the equivalent of just £5/month and helps CreditLadder to cover the cost of providing the service.

Credit Building Plans

Report rent to one Credit Reference Agency for free. Make your rent count by reporting to all three - Experian, Equifax & TransUnion - and let many more lenders see your rent payment history.

CREDITLADDER

STANDARD

- Report to 1 credit agency only. Choose Experian, Equifax or TransUnion.

- Once you have made your choice, switching is not possible.

- Upgrade to CreditLadder Premium at any time allowing you to report to Experian, Equifax & TransUnion.

CreditLadder Premium

Annual

* equivalent monthly price, £60 payment for 12 months.

- The first way to report your rent to the UK's largest credit agencies.

- Boost your credit position across Experian, Equifax and TransUnion.

- Pay annually and save over 35%

- 12 month contract.

CREDITLADDER PREMIUM

MONTHLY

- The first way to report your rent to the UK's largest credit agencies.

- Boost your credit position across Experian, Equifax and TransUnion.

- No long term commitment. 1-month notice to cancel.