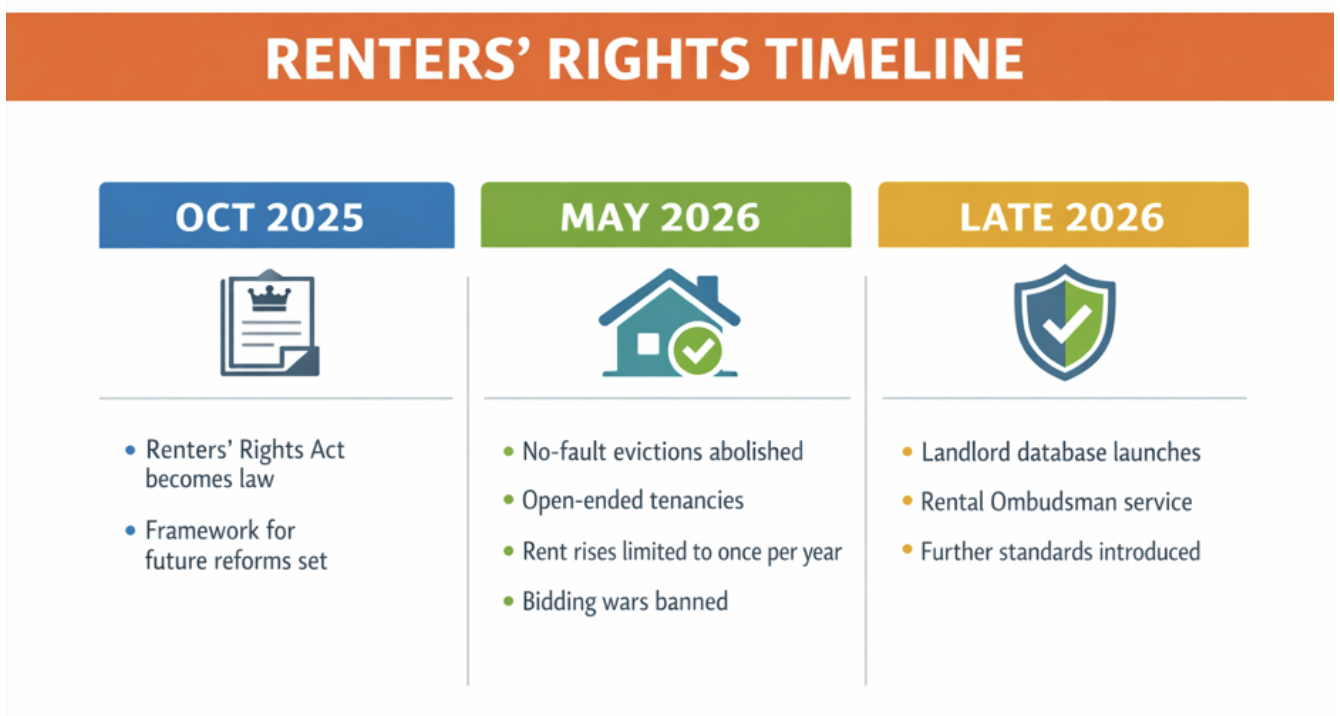

The Renters’ Rights Act (formerly the Renters Reform Bill) is bringing the biggest changes to private renting in decades. These reforms are designed to give tenants more security, fairer rent practices, and stronger protections.

📅 Key Dates

1 May 2026 – Most major changes take effect:

No more Section 21 “no-fault” evictions – landlords must have a legal reason to ask you to leave.

Open-ended periodic tenancies – fixed-term agreements end - tenants can leave with two months' notice.

Rent increases limited to once a year

Bidding wars banned - properties can’t be rented out for more than the advertised price.

Late 2026 – A Private Rented Sector database and Landlord Ombudsman will launch to make dispute resolution easier.

What You Should Do Now

Check your tenancy agreement – know your current rights.

Keep records – rent, bills, repairs, and communication.

Update your contact info – ensure your landlord can reach you.

Plan ahead – stay informed on the Ombudsman and property standards.

With so many changes taking place it’s important for both tenants and landlords to stay on top of the changes that are coming their way.

Remember, CreditLadder can help you improve your credit score.

CreditLadder can improve your credit position by reporting your rent payments. CreditLadder is the first way to improve your credit score and position across all three of the main Credit Reference Agencies in the UK, namely Experian, Equifax and TransUnion. Building up a high credit score has a lot of benefits, including helping you access finance at better rates - this can also help save you money. CreditLadder also runs a free mortgage application service in partnership with Tembo which will tell you how much you could borrow.

Remember the content provided in this article is for information purposes only and should not be considered as advice.