It's not a phone call many tenants enjoy taking, but if they stick around long enough at a property then the landlord will eventually put the rent up.

But tenants shouldn't worry. There are guidelines and laws that limit how much rent can be put up, and when. Here’s our guide to the ins and outs.

In a nutshell

During the fixed term of a rental contract the rent cannot be increased without the tenant agreeing to it.

Also, the contract will set out how often the rent can be increased after the fixed period ends - usually once a year - and by how much (most say “to keep pace with market rates” or similar) so examine the contract carefully before signing it.

Step 1: Before moving in

When someone signs a tenancy agreement, they should read it very carefully. They are not all standard. Although rental contracts may include details of when and by how much the rent can be increased, that doesn't mean the tenants has to go along with the terms. Haggling is allowed.

Step 2: After signing

The law says a property’s rent cannot be increased during the fixed period, the length of which will set out in the rental contract. Most fixed periods vary from six months to a year while some can be as long as 18 months. To put up the rent before the fixed period ends, the landlord must get the tenant’s agreement - they can’t just force a rise through.

Step 3: When you’re living there

After the fixed period ends the landlord can put up the rent, but the rent rise must be “fair and realistic” (the government says*) and comparable with the local market rents for a similar property. A landlord must also give their tenant a month’s notice when proposing a rent rise.

Step 4: Time for a tribunal

If a tenant (in England) thinks the proposed rent rise doesn't follow these rules then they can apply to a First Tier Tribunal, which will look at their case and make a binding decision. There are different systems in Scotland and Wales for working out what ‘fair’ or ‘market’ rents are.

Step 5: What is market rent?

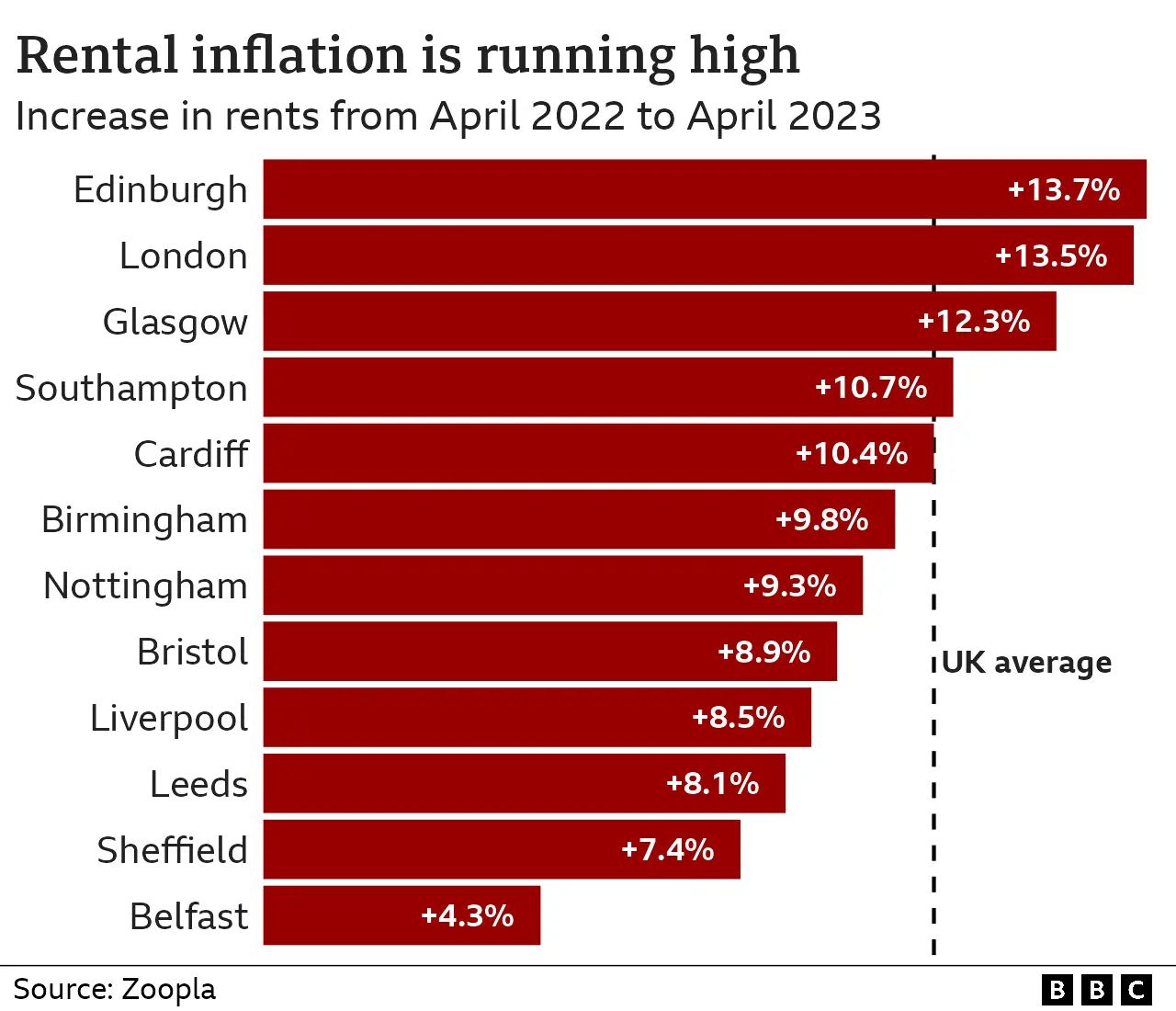

The tribunal will adjudicate on what they believe the local market rent is, but it's worth keeping an eye on local rents. Latest data shows rents are up 10% in a year and over 20 requests made to view each available property.

A recent study commissioned by the BBC has shown that on average, there are 20 requests to view each available rental property that comes onto the market - that’s more than tripled from six in 2019 that Rightmove showed.

And 20 is the average - we recently spoke to a landlord who had over 70 enquiries for his flat in London in just two days.

The graph below shows how rent has changed in major cities between April 2022 and April 2023.

Links

* = https://www.gov.uk/private-renting/rent-increases

Remember, CreditLadder can help you improve your credit score

Tenants can improve their credit score without having to borrow money. If you want to improve your credit position by reporting your rent payments, CreditLadder is the first way to improve your credit score and position across all four of the main Credit Reference Agencies in the UK, namely Experian, Equifax, TransUnion and Crediva.

CreditLadder also runs a free mortgage application service which will tell you how much you could borrow.

CreditLadder can help you improve your credit score

If you want to improve your credit position by reporting your rent payments, CreditLadder is the only way to improve your credit score and position across all four of the main Credit Reference Agencies in the UK, namely Experian, Equifax, TransUnion and Crediva. Building up a high credit score has a lot of benefits, including helping you access finance at better rates - this can also help save you money.

CreditLadder also runs a free mortgage application service in partnership with Tembo which will tell you how much you could borrow.

Remember the information provided in this article is for information purposes only and should not be considered as advice.