Welcome to the world of mortgages

Now you’ve decided which house or flat you want to buy, how are you going to afford it?

To find out, it’s now time to dip a toe into the sometimes bewildering system of mortgage lending. Anyone clambering onto the property ladder needs a home loan to fund their desire for bricks and mortar. So the time has come to understand what you’re getting involved with.

We’ve boiled the process down into a concise guide that, we hope, will equip first time buyers with the information and expertise they need. Fasten your seat belts.

How mortgages work

A mortgage is just a big fat loan and one which - unlike credit cards or car loans - is secured against the value of the home someone is buying. It’s why lenders take so much care to check the property is worth the money being offered for it.

The size of the mortgage will depend on the price of the property, but all mortgage lenders require borrowers to put down a deposit, usually of at least 10%. It’s both a way of testing how committed a borrower is but it’s also about LTV (see below) which is the size of your loan as a percentage of the property’s value.

What is LTV?

Loan to Value is the most crucial factor for most lenders and stands for Loan to Value - i.e. the loan as a percentage of the property’s purchase price. So an £85,000 loan for a £100,000 property has an LTV of 85%.

The lower the LTV, the more likely a lender will loan a homebuyer the money, and the better the rate they will get. It’s all about risk. The less someone borrows and the more money of their own they save up, the less risky the loan looks to a lender and the lower the interest rate will be.

According to the government the average LTV in the UK is 83%.

This standard for first-time buyers is an LTV of 90%.

Once that’s sorted, it’s time to decide what kind of mortgage suits you. This is about how long you take to pay the loan off and the sort of deal (and amount of interest) you pay.

Interest on a mortgage, like any loan, is expressed as an Annual Percentage Rate or APR so if the mortgage is advertised as a 4.5% interest rate, that means each year you’ll pay 4.5% of the outstanding loan as 12 monthly installments.

Until recently a lot of mortgages were ‘interest-only’ but now most are repayment ones, which means the monthly payment will include both the interest and some cash to begin chipping away at the outstanding loan, called the ‘repayment element’.

How much the monthly mortgage payments are will depend on two things - the interest rate paid on the loan (which is why newspapers always have headlines about changing interest rates; it affects so many people) and the length of the loan.

The shorter the repayment period, the bigger the ‘repayment element’ needs to be to pay the mortgage off. This is why, as house prices increase every year, mortgage terms - as they are called - are getting longer to make the monthly payments more affordable. At the moment that’s also helped by current low interest rates.

Read our comprehensive step-by-step guide to getting mortgage ready.

Mortgage example

Here’s an example of a mortgage we’ve picked to illustrate the typical deal many people sign up for in the UK.

House value: £234,000 (the national average)

10% deposit: £23,400

Mortgage: £210,600

APR: 3.7%

Type: Five-year fixed

Monthly repayments: £970.44

Term: 25 years

Based on a couple with a joint income of £45,000.

Income multiple: 4.68 (mortgage divided by income)

How mortgage interest works

Lastly, a decision needs to be made about what sort of interest rate set-up is best. There are approximately six different types. Here’s how they work.

Mortgage types

Standard Variable Rate or SVR

This is a no-frills mortgage that simply charges you the lender’s standard APR which can go up and down. Most people only go on this rate after finishing an initial fixed, tracker or discount mortgage rate (see below).

Fixed rate

This is one of the most popular types of mortgages because, usually for between two, three or five years, the lender offers you a fixed rate that’s lower than its SVR (see above).

Discount rate

This is a kind of variable rate mortgage because it tracks a few percent points below the lender’s SVR (see above). So it’s cheaper than the SVR but is variable so mortgage payments may increase - or decrease, if you’re lucky!

Tracker

A tracker is essentially the same as a discount, but instead of tracking BELOW the lender’s SVR, it tracks a few percentage points above the Bank of England base rate.

Offset

An offset mortgage is an interesting alternative to mainstream mortgages. They merge a current account and mortgage into one. The idea is that as someone is paid each month (and the mortgage total dips for a few weeks) this reduces the interest paid in the long term. It also creates a personal ‘piggy bank’ that borrowers can dip in and out of when needed.

In a nutshell

Remember that the choice boils down to this - the mortgage rate is a form of double-guessing the economy. Do you want the safety (but extra expense) of a fixed rate introductory period, or the lower cost but higher risk of going on a variable rate mortgage like a tracker or discount? The choice is yours.

How to apply for a mortgage

There are quite a few ways to apply for a mortgage whether it’s by popping into or phoning up your high street bank or - increasingly these days - applying online.

One recent development is that banks will now give you an ‘agreement in principle’ online after you’ve filled out a dozen or more basic questions about you and your financial history. This, once you’ve found somewhere to buy and you’ve made an offer, can then be used to begin the application process.

CreditLadder can help here. Send an email to mortgages@creditladder.co.uk and we’ll help you take your first steps.

Or read our guide to getting ready to apply for a mortgage.

Why adding rental payments to your credit history is important

After someone has applied for a mortgage and submitted all the information and paperwork requested, the lender then looks into their financial background to see how reliable they have been in the past repaying debt/loans.

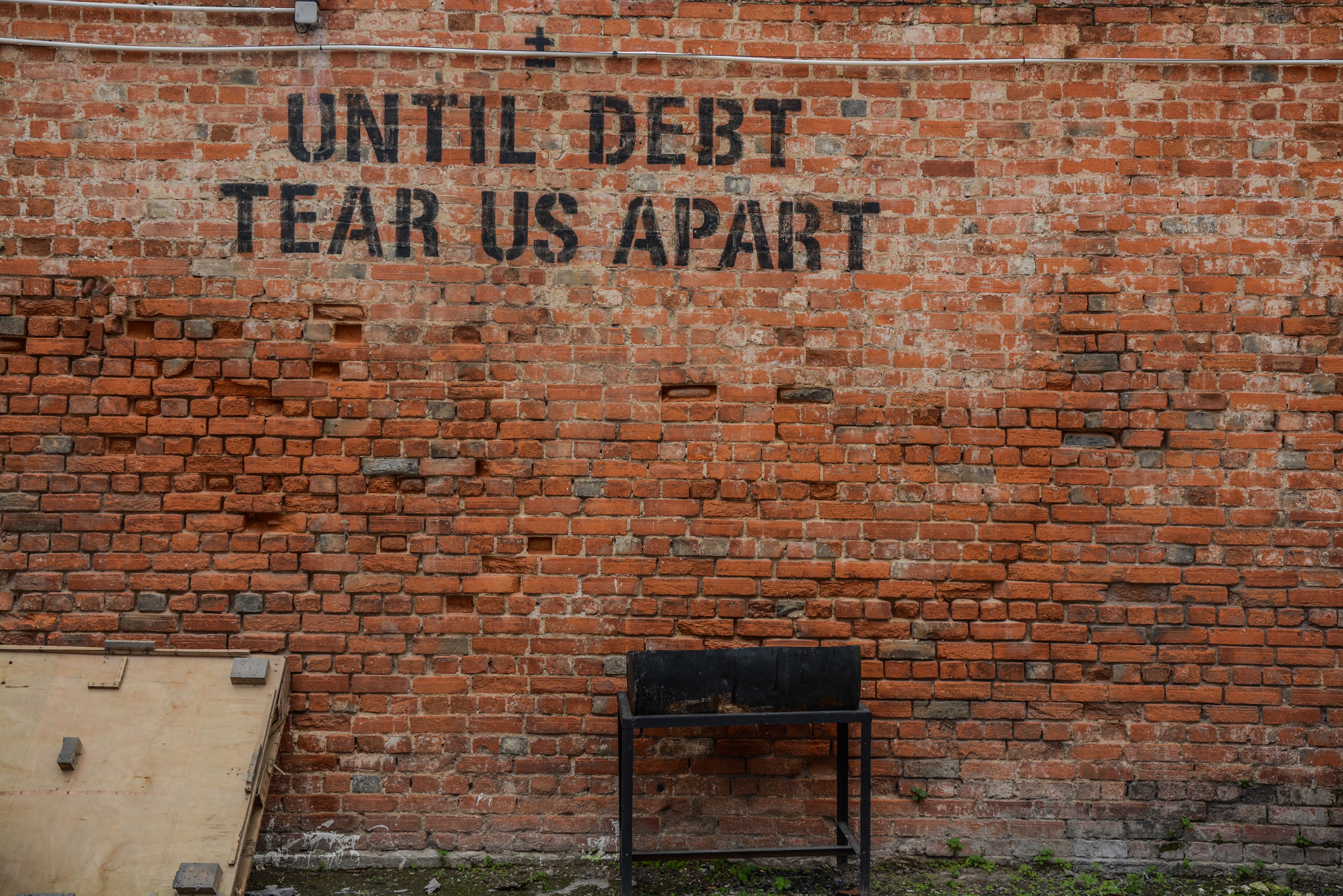

Until CreditLadder came along, one of most tenant’s biggest expenses was their rent but despite this it wasn’t included in their credit history. Now tenants CAN begin adding their renting track record to their credit score. Find out how here.

Mortgage Market Review (MMR) What is it?

Few people are aware of what the MMR was, or that it has dramatically changed who banks will lend to, and how much they will lend.

After the global financial crash during the late noughties the government decided that careless mortgage lending had been partly been to blame for the crisis.

So the then financial watchdog, now called the Financial Conduct Authority, was told to force lenders to reform their lending rulebooks and ‘stress test’ borrowers to ensure they can afford to continue paying their mortgage if interest rates increase.

When applying for a mortgage, remember you’ll be asked VERY detailed questions about your monthly expenditure and bills. So start working out how much you spend every month.

CreditLadder can help you improve your credit score

If you want to improve your credit position by reporting your rent payments, CreditLadder is the only way to improve your credit score and position across all four of the main Credit Reference Agencies in the UK, namely Experian, Equifax, TransUnion and Crediva. Building up a high credit score has a lot of benefits, including helping you access finance at better rates - this can also help save you money.

CreditLadder also runs a free mortgage application service in partnership with Tembo which will tell you how much you could borrow.

Remember the information provided in this article is for information purposes only and should not be considered as advice.